JuliusWong

-

Content Count

3,992 -

Joined

-

Last visited

Posts posted by JuliusWong

-

-

32 minutes ago, jahur said:Batik Air Malaysia ceases ATR72-600 ops

Looks like finally out on the press.

Yes, the last two months only SZB-BTH was operating with only one ATR 72 9M-LMH operating. It operated the last flight OD303 BTH-SZB on February 17, 2024.

-

34 minutes ago, Robert said:suspect it will be a cramped cabin with 29' seat pitch. Gate staff will need to be strict with hand luggage because cabin bins are a lot smaller than the A320.

Will be very cramped. This seat map is from Helvetic Airways E190-E2 with 110 seats.

-

Scoot to fly new Embraer jets to six destinations in Malaysia and Thailand

Esther Loi UPDATED MAR 05, 2024, 09:34 PM

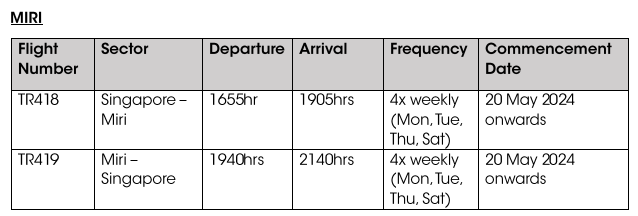

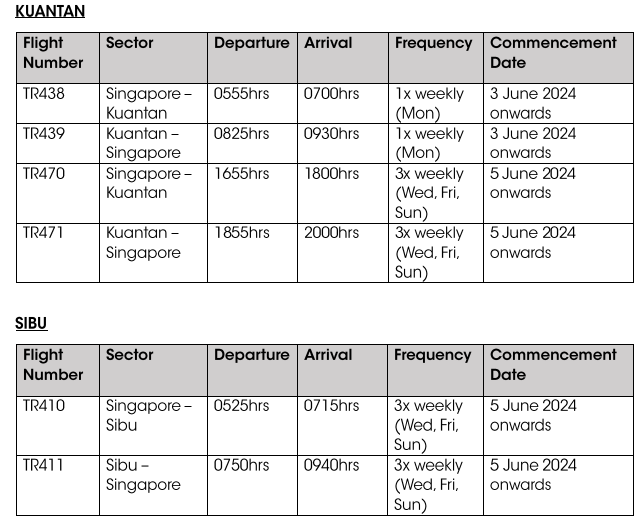

SINGAPORE - From May 2024, Scoot will operate flights from Singapore to six South-east Asian destinations with its new fleet of Embraer E190-E2 planes.

The six places are new destinations Koh Samui in Thailand and Sibu in Malaysia, as well as existing destinations comprising Hat Yai and Krabi in Thailand, and Kuantan and Miri in Malaysia, said Singapore Airlines’ budget arm Scoot in a statement on March 5.

The airline’s E190-E2 services are expected to start on May 7, after the first jet is delivered in April, said Scoot.

Flights to Krabi, Hat Yai and Koh Samui in Thailand, as well as Miri in Malaysia will begin in May, while flights to Kuantan and Sibu in Malaysia will start from June.

The first E190-E2 jet will be used on Scoot’s existing flights to Hat Yai and Krabi from May 7, increasing flight frequencies to both destinations from seven to 10 times every week.

This comes after Scoot initially said in a statement that the first plane was expected to arrive in March, as part of the five that will be delivered in 2024, when announcing its purchase of nine Embraer planes on Feb 17.

The airline later updated that four more jets will be delivered by the end of 2024, with the remaining four arriving by the end of 2025, according to Embraer’s Asia-Pacific vice-president Raul Villaron, who was speaking at a media launch of a flight simulator for Embraer E2 jets at the Singapore-CAE Flight Training Centre on Feb 20.

Scoot added on March 5 that the second E190-E2 jet is also scheduled for delivery in April, allowing the carrier to operate flights to four more cities: Koh Samui in Thailand, as well as Sibu, Kuantan and Miri in Malaysia.

With the delivery of these two planes, the airline will operate 103 and 92 weekly flights to Malaysia and Thailand respectively by June.

The new routes to Koh Samui and Sibu will increase Scoot’s network to 69 destinations.

Sales for these flights operated by E190-E2 jets will be progressively available for booking via Scoot’s website, mobile app and other channels. Economy class fares, inclusive of taxes, start from $172 to Koh Samui and $72 to Sibu.

The E190-E2 jet has a range of 5,278km, or six hours of flight time. As the smallest aircraft in Scoot’s fleet, it can seat up to 112 passengers.

-

2 hours ago, Robert said:They should take a day trip to Changi and take the best and implement at KLIA.

You don't need crap like this at Changi to drop your bags etc : https://www.thestar.com.my/starpicks/2023/12/15/the-new-face-of-airport-security.

Immigration at Changi is now gates for departing passengers and many can use gates for arrival. KLIA Immigration has 10 countries and you still need to queue for the first time.

Transiting between airlines is easy at Changi but the impression I have at KLIA is poor because many often counters airside are not manned and signage is poor.I think those EzPaz and EzBagz....facial recognition and self bag drop are part of IATA worldwide program to reduce the airline operation cost, airport around the region are rolling out the same. It would only be prudent KLIA and those international airport getaway do the same. I saw the same in DMK and HAN recently. Tried those HKG one recently, the system took less than a sec to recognise my boarding pass and my face.

As for immigration, the Changi departure might not be the best, tried it thrice thus far, not sure if it was my bad luck I had two breakdowns. At one time I was stuck within the gate. Then they quickly deployed the staff to do manual stamp out. The lines were pretty long due to evening departures. But kudos to the officers, they knew which flight is near to departure, they shouted (in good tone) to ask those pax to move to the front. For Malaysia arrival, the first time arrival is for capturing face and thumbprint if I am not mistaken. Thereafter you don't need to anymore. Correct me if I am wrong.

Yes, for transitting in KLIA could be better. I think they are in the next phase of upgrade. They don't much time left. Year 2026 is Visit Malaysia year. We have wasted too much time in the last decade and from 2020 to 2022...Malaysia, Singapore, Thailand and The Philippines are going for head to head competition. Malaysia and Thailand seems to have upper hand now, but let's hope they do not rest on laurel.

-

Seems like the government is dead serious in revamping KLIA and other airports. Do or die mission it is.

QuoteKhazanah, EPF and GIP forming consortium to run MAHB

By Jose Barrock / The Edge Malaysia 04 Mar 2024, 03:30 pm

https://theedgemalaysia.com/node/702332

KHAZANAH Nasional Bhd, the Employees Provident Fund (EPF) and New York-headquartered private equity (PE) firm Global Infrastructure Partners (GIP) are understood to be forming a consortium to own and run airport operator Malaysia Airports Holdings Bhd, say sources familiar with the arrangement.

The Edge is given to understand that if all goes to plan, an agreement could be inked in as early as two to three weeks and may involve some form of equity participation on the part of GIP, although details are lacking at the moment.

Khazanah is currently the largest shareholder of MAHB with a 32.67% stake, while EPF has 7.06% equity interest in the airport operator.

How the consortium will run MAHB is not clear. MAHB manages a total of 39 airports across Malaysia and wholly owns and manages Istanbul Sabiha Gokcen International Airport in Turkey. It also has an 11% stake in Rajiv Gandhi International Airport in Hyderabad, Telangana, India.

A tight-lipped source would only venture, “There will be a corporate exercise [involving the three consortium partners and MAHB].”

QuoteMAHB seeks to bring in new airlines for expansion

The airport operator aims to welcome them to Malaysia from as early as Q4 2024 or Q1 2025.Samuel Chua - 28 Feb 2024, 6:25pm

LANGKAWI: Malaysia Airports Holdings Bhd (MAHB) is setting its sights on attracting new airlines from North Asia, the Southwest Pacific and Europe as part of its strategy to enhance Malaysia’s status as a key hub of connectivity.

Senior general manager for strategy Megat Ardian Wira Aminuddin said MAHB aims to welcome these airlines to start operations or expand into Malaysia from as early as the fourth quarter of this year or early next year.

“We are targeting an increase from 69 airlines in 2019 to between 75 and 80 by the end of this year,” he said at Routes Asia 2024, hosted by MAHB and Tourism Malaysia.

Airlines from Europe are also targeted, though these services may not be as frequent as those from other regions, he said.

Megat said that in preparation for Visit Malaysia 2026, MAHB is in the process of upgrading its infrastructure and passenger experiences across its airports.

The initiatives include replacing the aerotrain in KLIA, upgrading the baggage handling system, expanding retail outlets and enhancing digital check-in facilities.

“These improvements are designed to create a seamless and efficient passenger experience from start to finish,” he said.

Megat also said MAHB would be committed to enhancing its other international airports, including those in Langkawi, Penang, Kota Kinabalu and Kuching.

“Digitalisation efforts and the expansion of retail and F&B options are under way, with several international airlines already showing interest in these locations.”

Meanwhile, MAHB acting group CEO Rastam Shahrom said Malaysia welcomed five new international airlines in January and February this year.

He said the latest additions are Air Macau, providing four weekly services from Macau; Loong Air, offering three weekly flights from Hangzhou; Turkmenistan Airlines, providing two weekly services from Ashgabat; and Iraqi Airways, resuming its weekly service to Baghdad.

After a decade of stagnant, finally we can see KLIA on the move again. Looking forward to seeing the new revamped KUL, LGK, PEN, KCH and BKI.

-

1 minute ago, jahur said:The amount of gulf carriers in BKK makes it harder for legacy EU carriers to leverage yields. Not helping subpar product and expensive tickets compared to what gulf can offer going into the front end of the cabins. TG is also always the losing end in this matter.

This is also one of the reason American carriers have been calling them out to no avail. But again these dumb white folks are always calling everyone for level playing field but always use the bailout card when things turn sour but call out others who have strong gov backing(to prevent any collapse) but at the same time these EU american carriers always lobby for goodies and shortcuts.

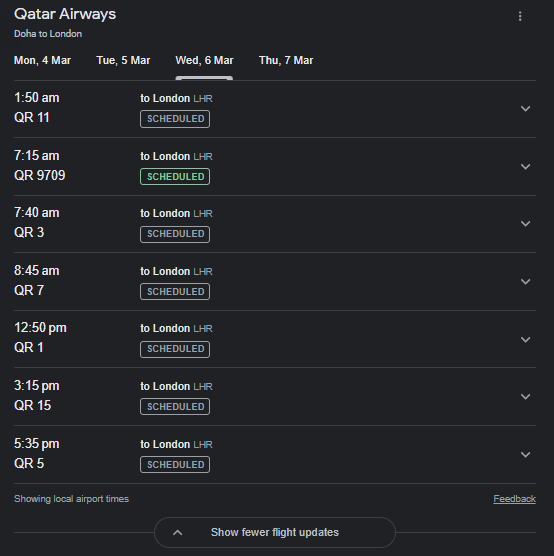

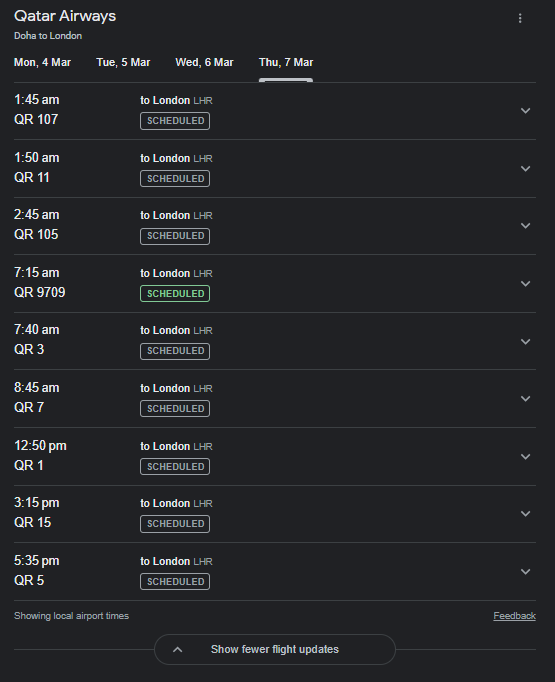

Just did a rough check on Qatar Airways departure to LHR over the next two days, absolutely crazy! QR9709 is code sharing with BA. UA and AA have given up on fighting ME3, they are now on the same beds at ME3. LOL. So much for Fair Skies~!

-

1 hour ago, Robert said:BA returns to KL and Bangkok

https://www.independent.co.uk/travel/news-and-advice/british-airways-kuala-lumpur-bangkok-ba-b2507041.htmlResuming with 7x weekly flight with B787-9.

I like how The Independent reporting the news about KUL. I am very surprised BA can't make BKK works with LHR. Qatar Airways has 6x daily flight! What the........I think one slot is lease from Royal Brunei.

QuoteHe said: “Kuala Lumpur has very few direct links to Europe so BA will be able to tap into unserved connections. Bangkok shifting to Gatwick shows the lower yields but popularity of the route.”

For decades Bangkok was a key destination for British Airways from London Heathrow. BA even launched a direct link from Manchester to the Thai capital, though it was soon dropped due to unprofitability.

Even before Covid, British Airways struggled to make money on the Heathrow-Bangkok link. The majority of UK visitors to Thailand now travel on the Gulf-based airlines: Emirates, Etihad and Qatar Airways. They offer vast amounts of capacity out of the UK via their hubs. Qatar Airways has six flights a day from Doha to Bangkok while Emirates operates five daily Airbus A380 “SuperJumbo” aircraft from Dubai to the Thai capital.

BA’s Heathrow operation is focused on premium cabins, and there is simply not sufficient demand to fill the more desirable seats profitably. Costs of operating from Gatwick are lower, allowing BA to set more competitive fares.

And the return of BA to KUL deserves some celebration.

-

The final A320ceo (9M-DAN MSN 3349, new registration VP-CAU) that was successfully delivered a few days before MYAirlines collapsed is now transiting in HNL, Hawaii on its return to the US.

-

3 hours ago, Pall said:To be honest, this are the two strongest market right now and moving forward. Producing the highest yield and healthiest load factor.

Last 3 months have seen a serious upswing for China market, with airlines in this region scrambling for capacity to ride the wave.

For India, they will never have enough aircraft to serve the growing middle class market. 470 aircraft order by Air India is literally not even close to MH ordering 20 A330neo in terms of population to aircraft ratio. What India lacks is sufficient infra to cope with the growing markets and bilateral traffic rights approval. They need newer secondary airports to reduce dependency on main hubs as well.

India will definitely be the next economy powerhouse for the next decade as China wanes off due to US-China trade conflicts for the past few years and also their dispute with SEA neighbours. China population is also seeing a decline now and India outranked China as the country with largest population last year. In 20 years' time, the newborns will fuel the economy growth. However India is now suffering from growth pains as the current infrastructures are unable to keep up with the growing population. Trains, road, airports, hospitals are unable to cope with the load. If they can pull off what China did after their ascension into WTO in 2001, they will be a force to reckon with.

As mentioned by you the bilateral rights is also one of the constraints. India can be notorious in granting rights into their primary hubs, let alone their secondary airports. Emirates and Etihad wanted more flights but the India government said no. Emirates has no choice but to deploy their high dense A380s on their routes to India. Despite the constraint, the India government also does not allow their own airlines or even international airlines to fly willingly from secondary airport bypassing the hub airport.

Airlines in India places a collective order for 1,172 new aircraft last year, the growth will be humongous. Meeting pilot and crew demand will be an issue. Airbus has opens a pilot training centre Tata Airbus Training Centre with Air India. India government and the local state governments are now busy building new airports to meet the increasing demands. Thankfully Boeing and Airbus supply chain issue slows down the growth a bit, but not much. Singapore Airlines has the first mover advantage now since they ventured into India with TATA with Vistara and now own shares in the revitalised Air India. Singapore Airlines are also using A380s on some of their India routes.

Will be interesting to know what Malaysia government and airlines in Malaysia game plan for India market now and in the next decade.

-

QuoteMalaysia Airlines is pleased to introduce the ‘Best of Asia’ menu which is available on selected sectors, promising an enhanced in-flight dining experience for its valued passengers.

Passengers will be treated to local and destination-inspired dishes; ensuring they enjoy delectable premium offerings onboard Malaysia Airlines.

We look forward to serving you delicious Asian cuisine onboard! ✈️

Book a trip now at malaysiaairlines.com or via the Malaysia Airlines mobile app.

-

On 2/8/2024 at 9:03 PM, JuliusWong said:Malaysia Airlines missed the boat to add eight A350. SE-RSC MSN391 is going back to SAS

On a side note, all remaining HNA A350s which were repossessed are now heading to Thai Airways.

SE-RSC was re-delivered to SAS last Saturday March 2, 2024 France local time.

-

20 minutes ago, jahur said:Heard the investors were very not keen on the refund requirement that was requested by the Gov as a minimum thing for a go ahead.

The new investors will burn few millions dollars even before his/her new airline takes off. Who in the right mind would want to do so? Unless those cryptocurrency, scammers want to burn off their ill gotten money.

Well well, they are talking to new investors now....This cat really has nine lives.

QuoteMYAirline in talks with new investors

Thursday, February 29th, 2024 at Business | News

KUALA LUMPUR — MYAirline said it is in talks with “promising new investors after a sudden and unilateral termination of a share purchase agreement by an investor from the Middle East.”

“In respect of this termination, all options are being considered, including possible legal action,” it said in a statement today.

Other potential investors have expressed an interest in reviving the brand, it added.

MYAirline said it is in “regular contact with all aviation regulators and we are committed to fulfilling any conditions and requirements mandated by the aviation regulators to regain its licenses and resume operations.” — BERNAMA / pic TMR FILE

I think lawsuit against the previous interested party should be last thing to do in their to-do list. LOL

-

QuoteMYAirline's future in limbo as Middle Eastern investors pull the plug on cash-strapped carrier?

By BILQIS BAHARI - February 29, 2024 @ 8:44amKUALA LUMPUR: MYAirline Sdn Bhd's supposedly final lifeline to resume operations is believed to have come to an end as its potential new investors are said to have pulled the plug albeit not on the 11th hour.

Business Times learnt that the potential new Middle Eastern investors decided not to pursue their interest any longer in the financially troubled low-cost carrier (LCC).

"There is bad news. The new investors for MYAirline have pulled out from MYAirline," sources told Business Times.

The break-up of the deal raises questions on the status of the refund payment that MYAirline had to pay to some 125,000 customers, the unpaid salaries and remuneration that it owes to its employees as well as the bills that are yet to be paid to its services providers.

Business Times has contacted MYAirline for comment and yet to receive a response as at press time.

On Feb 6, the Civil Aviation Authority of Malaysia (CAAM) confirmed that MYAirline's 10th and final Airbus A320 aircraft had been deregistered.

Currently the airline, which was established to stir the domestic and regional LCC markets, is fleetless.

It also does not have the air operator certificate (AOC) and air service licence (ASL) - two certificates that airlines need to have to operate a scheduled commercial airline operations in Malaysia.

One of the requirements for AOC issuance and renewal based on CAAM's Civil Aviation Directives (CAD) - 6004 is that an airline that wants to operate scheduled flights must have a minimum fleet of two aircraft.

On Jan 26, CAAM told Business Times that it had extended the suspension of MYAirline's AOC for another three months until April 14.

Another aviation regulator, the Malaysian Aviation Commission (Mavcom) had previously confirmed that it had received the new ASL application from MYAirline.

The carrier would need to secure a conditional ASL from Mavcom first before re-applying for AOC from CAAM and back to Mavcom for a full ASL prior to resuming its flight operations.

On Feb 7, Transport Minister Anthony Loke said he had met with MYAirline and its potential new investors and discussed on the way forward for the airline and how it would position itself should it resume operations.

When asked if the new investors were from the Middle East, Loke said MYAirline had informed the ministry that there were partners from the Middle East and a local company.

On Jan 12, Loke said a few conditions must be imposed before MYAirline could be back in business.

These included ensuring that all refunds are paid to affected passengers and payments to its staff are made as well.

"Without these two (conditions) no way, we can't compromise on this and thirdly in terms of their safety and such they must follow normal procedure," Loke was quoted by local media.

Sayonara forever?

-

Definitely need to hear the whole interview transcript before we should pass our judgement. Media, especially those in Malaysia, loves to sensationalize the story to earn clicks. Various media now are reporting bits and pieces of the whole interview.

That being said, the MSA split to MAS and SIA was the turning point. TAR wanted to prioritize the domestic front while LKY wanted to develop the international front. They never get along well. Never meant to be, better split up. Malaysia Airlines System was sealed after Mr. Tajuddin Ramli took over the the management in 1994. Many stuff were propped up artificially, and it all came crashing down down in 2001 after 9/11 incident. The successive management teams were limping from HDU to CCU to ICU......The airline never stood a chance to recover at all, basically with no money in their bank account forcing them to sell their assets. Like it or not, when you are a beggar, you cannot be choosy. While the public can say whatever they want with Idris Jala (2009 - 2011) being assets stripper, cutting the Group to bare bones, what could be done differently then when you have no cash in hand to fund your daily operation? Malaysia Airlines had 20,000 employees and reported losses of USD400 million in the 9 months leading to his entrance. In just 24 months of rigorous transformation, he produced a $260m profit (many said via selling off assets, but hey at least you have money to fund your operation). If you are given the post, what would you do differently compared to him? 2001 was also the rise of AirAsia.

In the subsequent years, MH saw several CEOs coming and leaving after a short period of time in the hot seat, Tengku Datuk Azmil Zahruddin (2009 - 2011), Ahmad Jauhari (2011 - 2015), Christoph Mueller (2015 - 2016), Peter Bellew (2016 - 2017), Izham Ismail (2017 - current), each CEOs had their own strategy but did not possess the strong will to make hard decision unfortunately.

Farnborough Airshow is in July this year, fingers crossed MAG has made their mind in placing another order for 20 A330-900neo and 20 A321neo/ B737 Max 10.

-

9 hours ago, KK Lee said:Find aero darat check in staffs are either poorly trained or don't take pride in their job. Unlike check in staffs of other airport and airlines; although they are idling, they don't signal next pax to come forward. It seems they are competing among themselves to ignore pax or keep idling the longest.

This seems to be normal occurrence in airports worldwide. Most, if not all major airlines, have divested or outsourced their ground service to third party company. Their employment terms are usually lesser than ideal from what they have been receiving when they were under the airline itself. Often long hours with minimum pay, but still need to fork out much money to eat at the airport. Some outsourcing companies even hire non-native to man the counters. That being said my encounter with AeroDarat was hit and miss. Some of them were very pleasant, some were just doing minimal smile.

My recent encounter with Swissport ground staff at Osaka Int'l Airport left too much to be desired for. I was flying AirAsia X, after long period of shadow ban. Ground staff were mostly non-local: Thai, Russians, Korean etc some barely speaking basic English language. Counter opened at 7:45am. Flight departing at 10:45am. I arrived at 8:00am. There were seven counters opened, two for premium customers, the rest for non-premium. There were no counter for online check in baggage drop and they did not divert the lines to premium lines even though there were no pax checking in there. It was so frustrating long check-in/baggage drop process. I only managed to drop my luggage and got my boarding pass at 9:25am. Boarding time was 9:45am. It was a mad rush to clear security check and immigration clearance. Thank God the security check was swift and there was no line at immigration counters. No time to explore the newly refurbished airside terminal.

-

11 hours ago, flee said:When I read that, I was highly skeptical - they have not received so many aircraft in a year before - right now, only AK and FD are capable of filling A321 Neos. If it is true that so many aircraft are coming from TLS, maybe the rest of the group will receive some - and old A320 Ceos may go to Cambodia or leave the fleet.

Assembling an A320neo will take around one to two months pre-COVID, I am pretty sure after the pandemic it will take slightly longer due to supply chain issue. We should be seeing A321neo in production sequence now if the first new delivery for this year is intended for June 2024. However, most production list does not show any AirAsia frames in queue. Maybe we will see lessors' frame delivered first or the production sequence will slot in March/April.

-

On 1/6/2024 at 9:16 PM, Tom/PER said:-XXR has returned from heavy maintenance in Manila and is back hard at work, anyone know what livery she’s returned in?

-XXR returned to service with the faded old airasia.com bold livery. Same as before. Guess they didn't repaint it due to busy period.

-

Unfortunately Batik Air has been cancelling flight left, right and center. The IG Reels below is from Feb 16-18, when OD271 was cancelled not once but twice. Kesian the frontline staff kena kao-kao from the passengers.

https://www.instagram.com/reel/C3h3PF_RreI/?igsh=ZHFjeWhlbDNibXk5

-

24 new aircraft delivery this year from June 2024, one new aircraft every week on average till Dec 2024. That is a lot of capacity to absorb with all deliveries being A321neo...not sure if he is quoted wrongly.

-

QuoteAirAsia converts A321neo to LRs; to resume deliveries

https://www.ch-aviation.com/news/137444-airasia-converts-a321neo-to-lrs-to-resume-deliveries

AirAsia (AK, Kuala Lumpur International) has converted 36 orders for A321-200NX to the A321-200NX(LR) variant as it prepares its narrowbody fleet for a planned merger with the long-haul unit AirAsia X (D7, Kuala Lumpur International), the CEO of parent holding Capital A Tony Fernandes told reporters during a briefing.

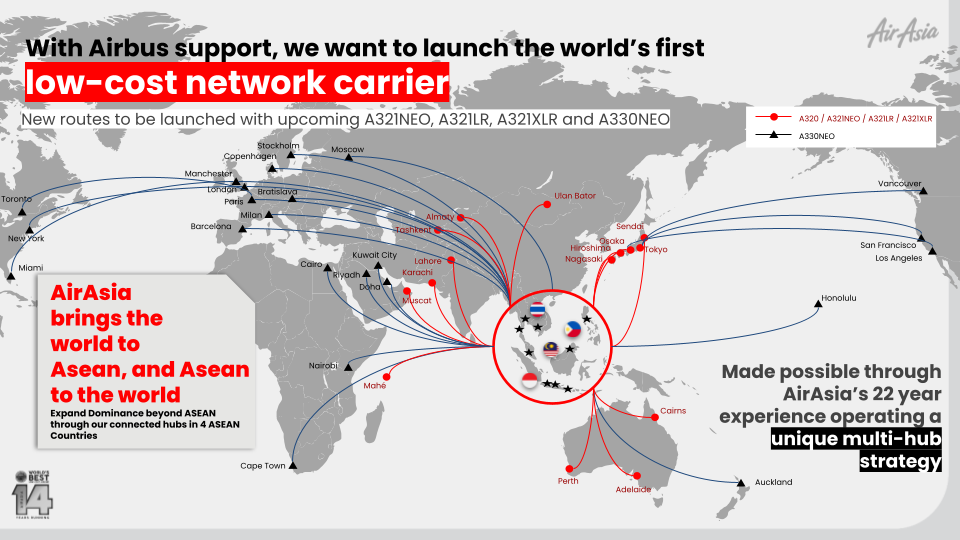

"It's traditionally never been done by low-cost carriers, but we believe now that with the aircraft that Airbus has given us, the A321-200NX, A321-200NX(LR), A330-900, and soon to come the A321-200NY(XLR), we can build the first global network carrier and connect the world with low fares through our hubs in Kuala Lumpur International, Bangkok Don Mueang, and Jakarta Soekarno-Hatta," he declared.

The A321-200NX(LR)s are scheduled to start delivering in 2025. AirAsia currently has a firm order for 362 A321-200NX powered by CFM International LEAP-1A engines, and the bulk of the commitment will remain in the non-(LR) variant for now. While AirAsia has not taken any new aircraft since the beginning of the Covid-19 pandemic, as it was heavily affected by restrictions on travel across Southeast Asia, it is now picking up the pace.

The ch-aviation fleets history module shows the last new aircraft to deliver to the group were three A321-200NX to AirAsia and Thai AirAsia (FD, Bangkok Don Mueang) inducted on December 31, 2019. Since then, the group has added a limited number of second-hand aircraft, but Fernandes expects deliveries direct from Airbus to resume in June 2024. A total of 24 new aircraft are expected by the end of this year.

In terms of the A320neo Family, the Malaysian carrier also operates twenty-nine A320-200Ns and two A321-200NX, while Thai AirAsia operates eleven A320neo and two A321neo. Both airlines, as well as Philippines AirAsia (Z2, Manila Ninoy Aquino International) and Indonesia AirAsia (QZ, Jakarta Soekarno-Hatta), also operate A320-200s.

The aircraft will complement the twenty A321-200NY(XLR)s on order by AirAsiaX. The long-haul unit currently operates eighteen A330-300s and has fifteen -900s on order.

Fernandes emphasised that the LRs would increase the carrier's flexibility in serving destinations in North Asia, Australia, and Central Asia. On an unrelated point, he pledged to launch services to Kenya - the group's first African destination - by the end of 2024. Going forward, the carrier plans to use the A330neo for a much broader intercontinental expansion, including through a host of fifth-freedom routes. Currently, the group's only intercontinental routes are to Australia.

"The network expansion is to cities like London, Paris, Amsterdam Schiphol, Bratislava, Barcelona El Prat, Copenhagen Kastrup, Cairo International, Nairobi Jomo Kenyatta, and Cape Town International. East Coast in North America - New York, Miami International, Toronto Pearson - will be via Europe, and West Coast - San Francisco, Los Angeles International, Vancouver International - via Japan," he said.

Fernandes added that the proposed sale of AirAsia and AirAsia Aviation Group, the investment vehicle for AirAsia-branded carriers outside Malaysia, to AirAsia X was progressing.

"It's moving. It's off the airbridge. It's moving towards the runway," he said. "The stages would be approval from the stock exchange, sale and purchase agreement signed, shareholders' approval, court and raising capital. To do this plan, we also need to raise capital".

-

QuoteAirAsia converts 36 of its A321neo orders to A321LRs, awaits Bursa's nod over merger

By BILQIS BAHARI - February 22, 2024 @ 8:24pm

SEPANG: Capital A Bhd's airline unit AirAsia Bhd has converted 36 of its A321neo (new engine option) orders to A321LR (long-range) as it aims to merge its short-haul and long-haul divisions into one global network.

The company's chief executive officer (CEO) Tan Sri Tony Fernandes said the decision to change the aircraft type is so that AirAsia could have more flying range to connect the Southeast Asia region to Africa, Europe and America.

"It's traditionally never been done by low-cost carriers but we believe now that with the aircraft that Airbus has given us – the A321, A321LR, A330neo and soon to come the A321XLR (extra long-range), we can build the first global network carrier and connect the world with low fares through our hubs in Kuala Lumpur, Bangkok and Jakarta," he said.

Tony added that the A321LR aircraft is slated to be delivered starting 2025.

The current order book (after the aircraft type conversion) for AirAsia Aviation Group Ltd (AAGL) – an umbrella company for AirAsia and its subsidiaries in Thailand, Indonesia, the Philippines and Cambodia – and AirAsia X Bhd including its Thailand and Indonesia units stood at 647.

Of the 647 airplanes, 326 are A321neos, 36 A321LRs and 15 A330neos, 20 A321XLR (extra long-range) and 250 aircraft comprises of A320s, A321neos and A330ceos (current engine option) which were delivered from 2005.

QuoteAirAsia reveals plan to become the world’s first low-cost network carrier during Airbus’ leadership visit

Airbus’ Commercial Aircraft CEO Christian Scherer celebrates long-standing partnership with AirAsia during a visit to HQ

SEPANG, 22 February 2024 - AirAsia today unveiled plans to launch the world’s first low-cost network carrier, leveraging 22 years of its unique multi-hub strategy through its airlines in Malaysia, Thailand, Indonesia, the Philippines, and soon Cambodia.

The announcement was made during a welcoming ceremony of the recently appointed Chief Executive Officer of the Commercial Aircraft business of Airbus, Christian Scherer, to RedQ - AirAsia’s corporate headquarters in Malaysia. Hundreds of AirAsia staff, CEOs and management turned out in force to greet the illustrious Airbus leader during his first visit as CEO to the home of over 6,000 team members called Allstars.

-

15 minutes ago, Craig said:I thought VJ wasn't doing too well financially? It's no Bamboo Airways but that's provisional order is as big as MH's 339 fleet.

They have been recording profit since emerging from the COVID 19 restrictions.

QuoteVietjet Air reports profit after audit

Budget carrier Vietjet Air has announced its audited biannual financial statements in 2023, with air transport revenue and consolidated revenue hitting 25.1 trillion VND (1.03 billion USD) and 29.5 trillion VND (1.21 billion USD), up 69% and 85% year-on-year, respectively.https://en.vietnamplus.vn/vietjet-air-reports-profit-after-audit/267525.vnp

VNA Thursday, September 07, 2023 14:32Hanoi (VNA) - Budget carrier Vietjet Air has announced its audited biannual financial statements in 2023, with air transport revenue and consolidated revenue hitting 25.1 trillion VND (1.03 billion USD) and 29.5 trillion VND (1.21 billion USD), up 69% and 85% year-on-year, respectively.

Ancillary revenue maintained a high growth rate, reaching 9 trillion VND, a two-fold increase from the same period last year, and accounting for 40% of the total revenue.

Separate and consolidated after-tax profits reached 48 billion VND and 137 billion VND, respectively, lower than the compiled financial statements due to higher marketing and advertising expenses for new international routes and deferred revenue of a financial revenue.

As of June 30, Vietjet's total assets reached over 71.2 trillion VND, while the debt/equity ratio and the liquidity ratio were 1.2 and 1.5, respectively, which were all within good range for the aviation industry.

By the end of the second quarter, Vietjet’s cash balance and cash equivalents reached 2.16 trillion VND. The airline paid a total of almost 2.8 trillion VND of direct and indirect taxes and fees to the State budget in the first six months of 2023.

Thanks to its sustainable business strategy, focusing on promoting the domestic market and pioneering a strong expansion of its international network to India, Australia, Kazakhstan, and Indonesia, Vietjet continued to record positive business performance in the reviewed period.

In the second quarter, Vietjet opened 11 new international routes to Australia, Indonesia, and India, lifting the total number of foreign routes to 75.

Vietjet was a pioneer in operating flights to the Indian market with seven routes connecting Hanoi and Ho Chi Minh City to Mumbai, Delhi, Ahmedabad, and Kochi.

Starting from mid-April 2023, the airline has opened three direct routes from HCM City to Australia's largest cities - Sydney, Melbourne, and Brisbane.

Malaysia will lose Thailand and Vietnam markets moving forward, time to gird lions MH, AK, D7. The competition will be very tough in the next decades with all the new aircraft orders and market expansion by all the airlines.

-

Something related to AirAsia market scope, Vietjet signs a provisional order with Airbus for 20 A330-900neos, to be delivered from 2026 onwards. This will take out a chunk of Fly-Thru passengers from AirAsia, especially on Vietnam-Australia market. AirAsia X will only resume A330-900neo delivery next year 2025, having 15 on order.

https://www.airbus.com/en/newsroom/press-releases/2024-02-vietjet-to-order-20-a330neo-widebodie

-

16 hours ago, Craig said:I am more curious if MH will announce any orders at the SG airshow. They aren't known for announcing orders at an airshow but the narrow body replacement and additionally wide bodies are supposed to be announced Q1 2024.

Airbus and Malaysia Airlines announces MOU for carbon emission studies during Singapore Airshow 2024.

QuoteAirbus, Malaysia Aviation Group ink MoU to conduct emissions studies

KUALA LUMPUR, Feb 19 — Airbus and Malaysia Aviation Group (MAG), the parent company of national carrier Malaysia Airlines Bhd, have signed a memorandum of understanding (MoU) to collaborate in conducting comprehensive studies on carbon emissions of the airline group.

In a statement today, Airbus said this significant step signifies the initiation of a two-year partnership between the two entities, dedicated to exploring various avenues for decarbonisation within MAG’s operations.

The MoU between Airbus and MAG encompasses five key areas of focus, namely sustainable aviation fuel (SAF); carbon dioxide removal (CDR); assessment of financial implications associated with CO2 reduction; forecast and scenario planning; and joint advocacy and communication efforts.

Malindo to be Rebranded as Batik Air Malaysia; Moved to MTB; to Partner ex MAS Codeshare Airlines

in General Aviation

Posted · Report reply

Gonna miss FY and OD turboprop operation from SZB. Near to my home, buy ticket, arrive one hour before, hop onboard, less than an hour you are at your holiday/ work destination!

With FY also exiting the turboprop business, SZB will be pretty empty. Time to catch those mozzies ATR 72 now before they are retire for good.